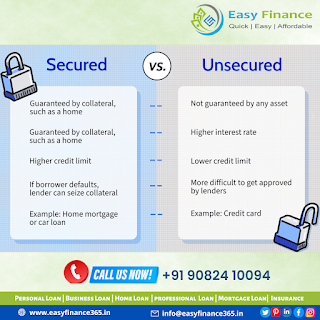

Secured vs. unsecured personal loans: What you need to know

When shopping for personal loans, borrowers will find that there are two main types of loans — secured personal loans and unsecured personal loans. Secured loans A secured loan is a type of loan in which a borrower pledges an asset such as a car, property, or equity etc., against that loan . The loan amount made available to the borrower is usually based on the value of the collateral. Pros Less stringent eligibility requirements Often has lower interest rates than unsecured loans Secured loans usually have higher borrowing limits than unsecured loans Cons Collateral can be taken if you default on the loan Failure to repay the loan as agree can damage your credit Where to get an unsecured loan Unsecured loans, like the name suggests, is a loan that is not secured by a collateral such as land, gold, etc . These loans are comparatively riskier to a lender and therefore associated with a high interest rate You can get an unsecured loan from a bank, credit union or online ...