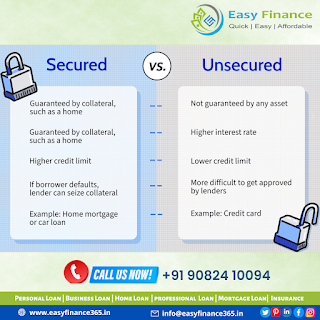

Secured vs. unsecured personal loans: What you need to know

When shopping for personal loans,

borrowers will find that there are two main types of loans — secured personal

loans and unsecured personal loans.

Secured loans

A secured loan is a type of loan in which a borrower pledges an asset such as a car, property, or equity etc., against that loan. The loan amount made available to the borrower is usually based on the value of the collateral.

Pros

- Less stringent eligibility requirements

- Often has lower interest rates than unsecured loans

- Secured loans usually have higher borrowing limits than unsecured loans

Cons

- Collateral can be taken if you default on the loan

- Failure to repay the loan as agree can damage your credit

Where to get an unsecured loan

You can get an unsecured loan from a bank, credit union or online lender.

Pros

- A lender can’t take your assets if you default on the loan, at least without a court’s permission

- No collateral required

- Unsecured loans usually have lower borrowing limits than secured loans

Cons

- Often has higher rates than secured loans

- May have a tough time qualifying with bad credit

- Defaulting on the loan can cause serious credit damage

For More assistance

easy finance Provide you the all in one Finance solution. To know more connect us on: +91 90824 10094

Fb Link : https://www.facebook.com/easyfinancekalyan

Insta link : https://www.instagram.com/easy.finance_

Location: Kimaya

Niwas , 1st Floor, opp Ratnadeep Hospital Shree Ram Talkies, Vitthalwadi,Kalyan

(E). #loan #finance #money #mortgage #loans #homeloan #personalloan #loanofficer #business #refinance #loanservices #businessloan #startuploan

Comments

Post a Comment