A Business Loan with Customer-Friendly Features & Benefits- EASY FINANCE

A Business Loan with Customer-Friendly Features & Benefits

Running a business successfully is a capital-intensive task. All enterprises incur a variety of expenses to ensure business operations run smoothly. Therefore, having easy access to capital at right time can make all the difference. At Easy Finance, we understand these needs and offer the Business Loan as a source of capital for all entrepreneurs. Borrowers can enjoy a myriad of cost-effective advantages of taking a Business Loan from us.

| Higher Loan Disbursal Amount Business expenditures and working capital require sufficient finance. One of the primary advantages you get with our Business Loan is access to capital up to ₹50 Lakh to fund any business-related expense without compromise. | |

| Swift and Smooth Disbursal The Easy Finance Business Loan is designed to suit your busy lifestyle and schedule. We offer quick loans online, ensuring you have a hassle-free experience whenever you need funds for your business. | |

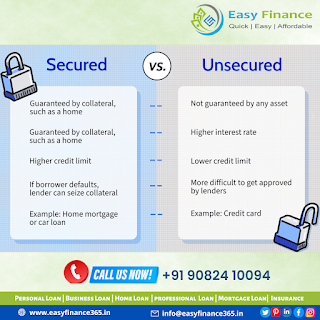

| Collateral free Loans Collateral free loan is our unique selling point and a major benefit that comes with our Business Loan. It is an unsecured offering, making it time-efficient and less risky to avail. You can access capital easily without the need to pledge any business or personal assets. | |

| Interest Rates When you opt for the Easy Finance Business Loan, you enjoy a competitive interest rate. Among the many Business Loan benefits, a low-interest rate makes our offering a cost-effective solution that you can rely on. | |

| Simplified Documentation Process To speed up loan processing, you are only required to submit basic Business Loan documents. Our simplified documentation process gives you an edge when borrowing from us over other financers, and therefore, acts as another advantage. | |

| Extended Loan Tenure Loan EMIs should never strain working capital reserves or cause a dip in your business profits. With our Business Loan, you don’t have to worry about this as you can opt for a flexible tenure ranging up to 36 months. This helps you plan your repayment optimally based on your business’s cash flow. | |

| Convenience of Online Process The accessibility of an online process to apply for a Business Loan is another Business Loan benefit. Access capital digitally and from the convenience of your home or business. Apply online and get instant approval, receive the funds to your account without any delay. |

Comments

Post a Comment