Know everything about our Personal Loan

What are the benefits of a Personal Loan?

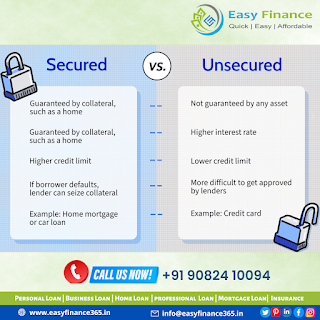

Our Personal Loan has a range of benefits. Right from a medical emergency, home renovation to higher education and debt consolidation, the Personal Loan can be used for meeting any financial requirement since it has no spending restrictions. This loan is unsecured and easy to avail. Other benefits include one of the lowest interest rates, flexible tenure options, sizable loan amounts, and a 100% digital process.

Applying for a Personal Loan in Easy finance is very easy and real quick. All you have to do is to meet the eligibility criteria, submit the required documents mentioned in the personal loan document list, and fill out an easy online application form.

Yes, you can get an instant approval for a Easy Finance Personal Loan. Do note that this benefit is only available to applicants who meet all the personal loan eligibility criteria.

How do I get the best interest rate for a Personal Loan?

There are many factors which drive the interest rate for a personal loan. Some of the tips to have best interest rate in loan are as follows:

- Meet all the eligibility criteria and submit the required documents

- Maintain a high Credit Score

- Have a good repayment track record and credit history

- Maintain employment stability and have a steady income

- Are there any advantages of unsecured Personal Loans?

Below are some of the advantages of unsecured personal loan over other loans :

- No need of collateral

- Quick funding time

- Flexibility in terms of use

- Low interest rate

- Flexible loan tenure

Comments

Post a Comment