What Types of Bank Loans in India

What Types of Bank Loans in India

Personal Loans:

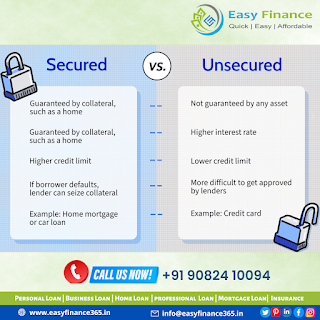

Most banks offer personal loans to their customers, and the money can be used for any expense like paying a bill or purchasing a new television. Generally, these loans are unsecured loans. The lender or the bank needs certain documents like proof of assets, proof of income, etc. You must remember that the rate of interest associated with these loans can be on the higher side.

Credit Card Loans:

When you are using a credit card, you must understand that you will have to repay all the purchases you make at the end of the billing cycle. Credit cards are accepted almost everywhere, even when you are travelling abroad. As it is one of the most convenient ways to pay for the things you buy, it has become a popular loan type.

Home Loans:

These loans generally come with longer tenures (20 years to 30 years). The rates offered by some of the top banks in India for their home loans start at 8.30%.

.png)

Car Loans:

A car loan helps you to pave the path between your dream of owning a car and actually buying it.

Car loans are secured loans. If you fail to pay your instalments, the lender will take back your car and recover the outstanding debt.

Two-Wheeler Loans:

A two-wheeler loan is easy to apply for. The amount you borrow under this loan type helps you purchase a two-wheeler. However, if you do not make timely payments and clear your debt, the insurer will repossess your motorcycle to recover the loan amount.

Small Business Loans:

Small business loans are loans that are provided to small and medium-sized businesses to meet various business requirements. These loans can be used for a variety of purposes that aid in growing the business.

Home Renovation Loan:

Home innovation loans are offered by most lenders. These can be availed of to meet the expenses related to the renovation, repair, or improvement of an existing residential property. Depending on the lender, there is a lot of flexibility with what you can do with a home renovation loan. You can use it to buy products or pay for services. For example, you can use it to pay for the services of a contractor, architect, or interior decorator. You can also use it to buy furniture, furnishings, or household appliances such as a refrigerator, washing machine, air conditioner, etc. It can be used for painting, carpentry, or masonry work as well.

Agriculture Loan:

Agriculture loans are loans that are provided to farmers to meet the expenses of their day-to-day or general agricultural requirements.

Gold Loan:

A loan against gold is a secured loan where gold is placed as security or collateral in return for a loan amount that corresponds to the per gramme market value of gold on the day that the gold has been pledged.

Loan against a credit card:

A loan against a credit card is like a personal loan that is taken out against your credit card. These are usually pre-approved loans that do not require any additional documentation.

Education Loan:

Depending on the lender, it will cover the basic fees of the course, the exam fees, accommodation fees, and other miscellaneous charges.

Consumer durable loan:

Consumer durable loans are loans that are availed to finance the purchase of consumer durables such as electronic gadgets and household appliances. depending on the lender.

Facebook Link: https://www.facebook.com/easyfinancekalyan

Instagram Link: https://www.instagram.com/easy.finance_

Location: Kimaya Niwas, 1st Floor, opp. Ratnadeep Hospital, Shree Ram Talkies, Vitthalwadi, Kalyan (E).

#loan #finance #money #mortgage #loans #homeloan #personalloan #loanofficer #business #refinance #loanservices #businessloan #businessloan

Comments

Post a Comment